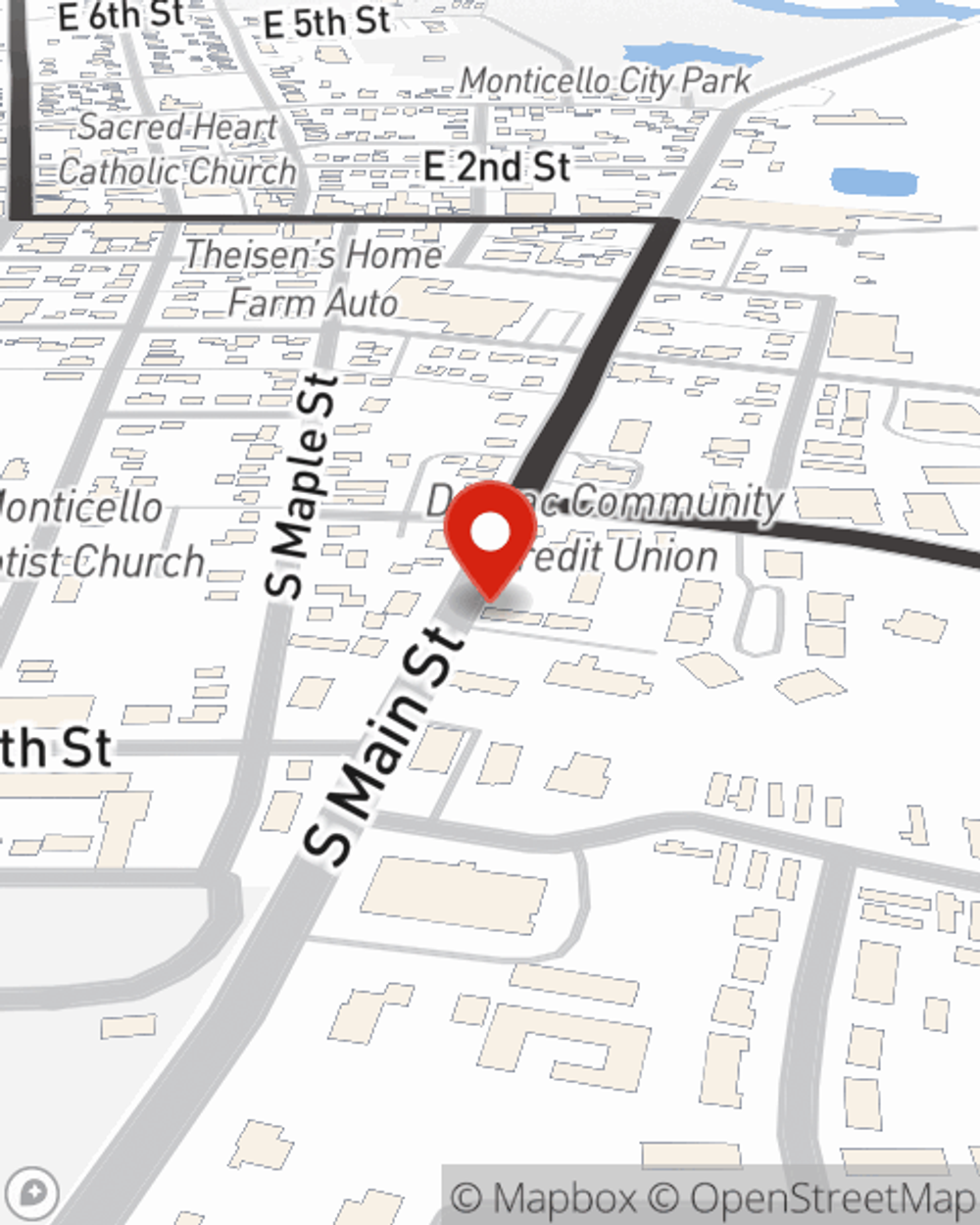

Business Insurance in and around Monticello

Monticello! Look no further for small business insurance.

Helping insure small businesses since 1935

- Monticello

- Anamosa

- Cascade

- Jones County

- Delaware County

- Wyoming

- Scotch Grove

- Hale

- Central City

- Center Junction

- Olin

- Onslow

- Springville

- Stone City

- Fairview

- Hopkinton

- Delhi

- Langworthy

- Dubuque County

- Linn County

Business Insurance At A Great Price!

Operating your small business takes hard work, time, and terrific insurance. That's why State Farm offers coverage options like a surety or fidelity bond, business continuity plans, worker's compensation for your employees, and more!

Monticello! Look no further for small business insurance.

Helping insure small businesses since 1935

Protect Your Future With State Farm

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a pet store, a camping store or a lawn care service business. Agent Rick Meyer is also a business owner and understands your needs. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Reach out agent Rick Meyer to explore your small business coverage options today.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Rick Meyer

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.